|

Ниже представлены результаты анализа МТС

(для портфеля акций РАО ЕЭС, Лукойла и Сбербанка в равных долях) с помощью

программы XpressAnal_v1.3 (konkop). Только лонг.

|

EESR_T26_L.csv

|

1

|

Tickers/Strategies

|

3

|

|

Capital per 1 trade

|

1000

|

$

|

|

LKOH_T26_L.csv

|

1

|

|

|

|

Comission (round)

|

0,20

|

%

|

|

SBER_T26_L.csv

|

1

|

Start date

|

05.01.00

|

|

End date

|

15.10.03

|

|

|

|

|

Start equity

|

3000

|

$

|

End equity

|

10752

|

$

|

|

|

|

Max. leverage

|

1

|

|

|

|

|

|

|

|

Total trades

|

1457

|

|

Profit factor

|

1,64

|

|

|

|

|

Math. expectation

|

0,53

|

%

|

Avg. win/loss

|

2,30

|

|

|

|

|

StdDev. trade

|

3,50

|

|

Avg.trade/StdDev.

|

0,15

|

|

|

|

|

Net profit

|

7752

|

$

|

Max DD

|

-22,60

|

%

|

|

|

|

Gross profit

|

19947

|

$

|

Gross loss

|

-12195

|

$

|

|

|

|

Win. trades

|

605

|

|

Los. trades

|

852

|

|

|

|

|

Perc. winning

|

42

|

%

|

Perc. losing

|

58

|

%

|

|

|

|

Avg. win

|

3,30

|

%

|

Avg. loss

|

-1,43

|

%

|

|

|

|

Largest win

|

27,90

|

%

|

Largest loss

|

-11,80

|

%

|

|

|

|

max conseq.win

|

9

|

|

max conseq.loss

|

14

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total return

|

258,39

|

%

|

|

|

|

|

|

|

Annual return

|

67,41

|

%

|

|

|

|

|

|

|

Ann.ret/max.DD

|

2,98

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Long trades

|

1433

|

|

Short trades

|

0

|

|

|

|

|

Long expectation

|

0,54

|

%

|

Short expectation

|

0,00

|

%

|

|

|

|

Long profit factor

|

1,64

|

|

Short profit factor

|

100,00

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Konkop

Xpress Analizator

|

|

|

|

|

|

|

|

v1.3 b.04

24.10.2002

|

|

|

|

|

|

|

|

© 2002

konkop

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

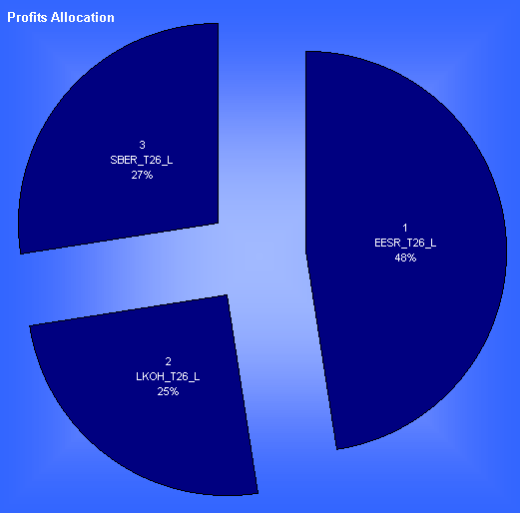

Таблица 1

Диаграмма 1

Диаграмма 2

|

Strategy

|

Ticker

|

Flag

|

Profit

|

|

New_Strategy

|

EESR_T26_L

|

1

|

3676,0994

|

|

New_Strategy

|

LKOH_T26_L

|

2

|

1945,8995

|

|

New_Strategy

|

SBER_T26_L

|

3

|

2129,6987

|

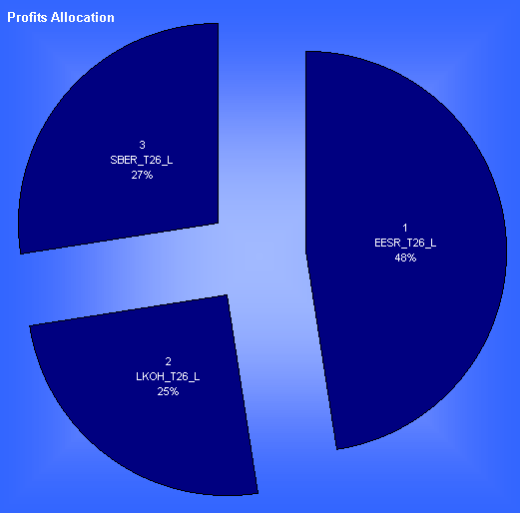

Таблица 2

Диаграмма 3

Ниже представлены результаты анализа МТС

(для акций РАО ЕЭС) с помощью программы XpressAnal_v1.3 (konkop).

Только лонг.

|

EESR_T26_L.csv

|

1

|

Tickers/Strategies

|

1

|

|

Capital per 1 trade

|

3000

|

$

|

|

|

|

|

|

|

Comission (round)

|

0,20

|

%

|

|

|

|

Start date

|

10.01.00

|

|

End date

|

15.10.03

|

|

|

|

|

Start equity

|

3000

|

$

|

End equity

|

14028

|

$

|

|

|

|

Max. leverage

|

1

|

|

|

|

|

|

|

|

Total trades

|

626

|

|

Profit factor

|

1,69

|

|

|

|

|

Math. expectation

|

0,59

|

%

|

Avg. win/loss

|

2,49

|

|

|

|

|

StdDev. trade

|

3,53

|

|

Avg.trade/StdDev.

|

0,17

|

|

|

|

|

Net profit

|

11028

|

$

|

Max DD

|

-33,78

|

%

|

|

|

|

Gross profit

|

27111

|

$

|

Gross loss

|

-16083

|

$

|

|

|

|

Win. trades

|

253

|

|

Los. trades

|

373

|

|

|

|

|

Perc. winning

|

40

|

%

|

Perc. losing

|

60

|

%

|

|

|

|

Avg. win

|

3,57

|

%

|

Avg. loss

|

-1,44

|

%

|

|

|

|

Largest win

|

27,81

|

%

|

Largest loss

|

-6,56

|

%

|

|

|

|

max conseq.win

|

6

|

|

max conseq.loss

|

9

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total return

|

367,61

|

%

|

|

|

|

|

|

|

Annual return

|

95,90

|

%

|

|

|

|

|

|

|

Ann.ret/max.DD

|

2,84

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Long trades

|

618

|

|

Short trades

|

0

|

|

|

|

|

Long expectation

|

0,60

|

%

|

Short expectation

|

0,00

|

%

|

|

|

|

Long profit factor

|

1,69

|

|

Short profit factor

|

100,00

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Konkop

Xpress Analizator

|

|

|

|

|

|

|

|

v1.3 b.04

24.10.2002

|

|

|

|

|

|

|

|

© 2002

konkop

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Таблица 3

Диаграмма 4

Диаграмма 5

|